Multi-Asset ESG

The next evolution in sustainable investing

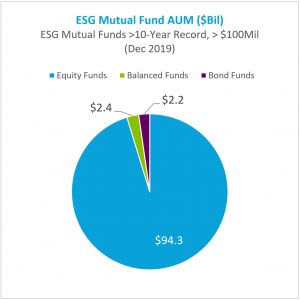

Despite the growing popularity of sustainable investing, ESG choices today are largely limited to equity securities alone. In fact, equity funds represent 95% of all ESG fund assets in our research as shown below.

But do today’s single-asset ESG offerings represent the pinnacle of sustainable investing?

Have ESG offerings achieved their full potential?

We don’t think so.

The emergence of multi-asset ESG offerings represents a significant improvement in at least four ways.

- Extend sustainability across a larger share of one’s portfolio;

- Reduce risk and diversify investors’ existing holdings;

- Potentially improve investment returns for fiduciaries;

- An “all weather” approach that seeks to match the perpetual commitment of ESG itself.

Multi-asset ESG extends sustainability across a larger share of one’s portfolio.

Today’s single-asset ESG offerings enable one to express ESG sentiment within a portion of one’s equity portfolio, but little else. A sizeable portion, and likely a majority, of one’s portfolio has few outlets for ESG expression.

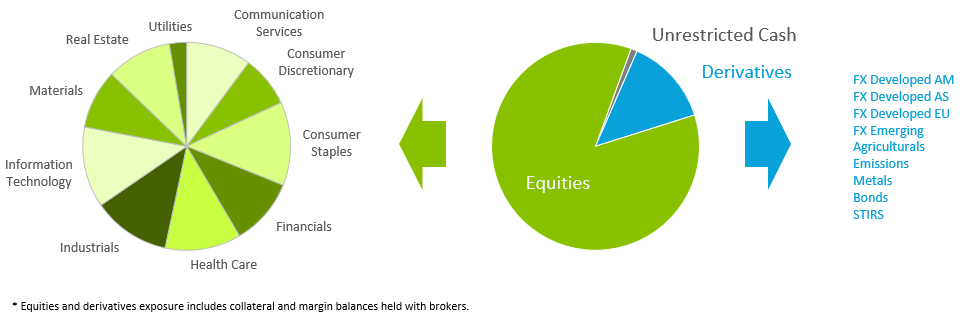

We believe multi-asset ESG portfolios can, and should, include other assets such as global equity indices, bonds, currencies and commodities such as agriculturals, emissions and metals.

Below is an example of Welton’s multi-asset ESG portfolio. Welton complements an ESG equity portfolio with a collection of multi-asset ESG derivatives to provide a source of diversification and equity drawdown mitigation.

Welton is one of the first to devise a framework for both scoring and then comparing diverse asset classes to build robust multi-asset ESG portfolios. To learn more, see “Towards the Development of an ESG Scoring Framework for Derivatives.”

Ongoing professional education is key to keep pace with ESG industry developments and in order for Welton to blaze new trails within sustainable investing. The CFA recently launched one of the first globally recognized accreditation programs in ESG investing. For those interested in learning more, see “Insights and Tips for Those Considering the CFA’s ‘Certificate in ESG Investing.”

Multi-asset ESG seeks to reduce risk and diversify ESG investors’ existing holdings.

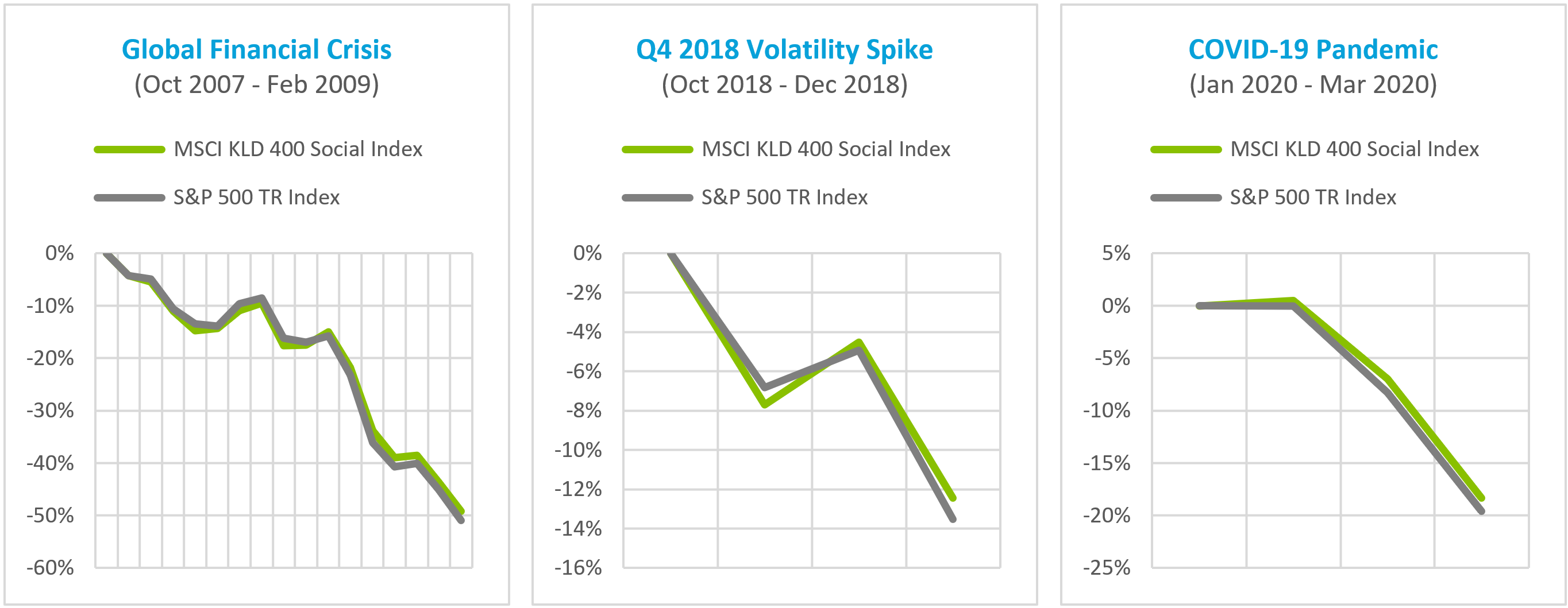

Today’s equity-only ESG offerings mirror the performance of the equity markets themselves.

Investors sometimes discuss the idiosyncratic risk benefits of ESG (i.e., the reduction in risk between particular equity issuers, such as between Company A vs. Company B), but not enough attention is paid to the far more material systemic risk of the markets themselves.

Using the MSCI KLD 400 Social Index as a proxy for ESG fund behavior generally, one can see that ESG investors suffered the same fate as passive market investors during selected equity crises over the last two decades.

Multi-asset ESG strives to improve investment returns for fiduciaries.

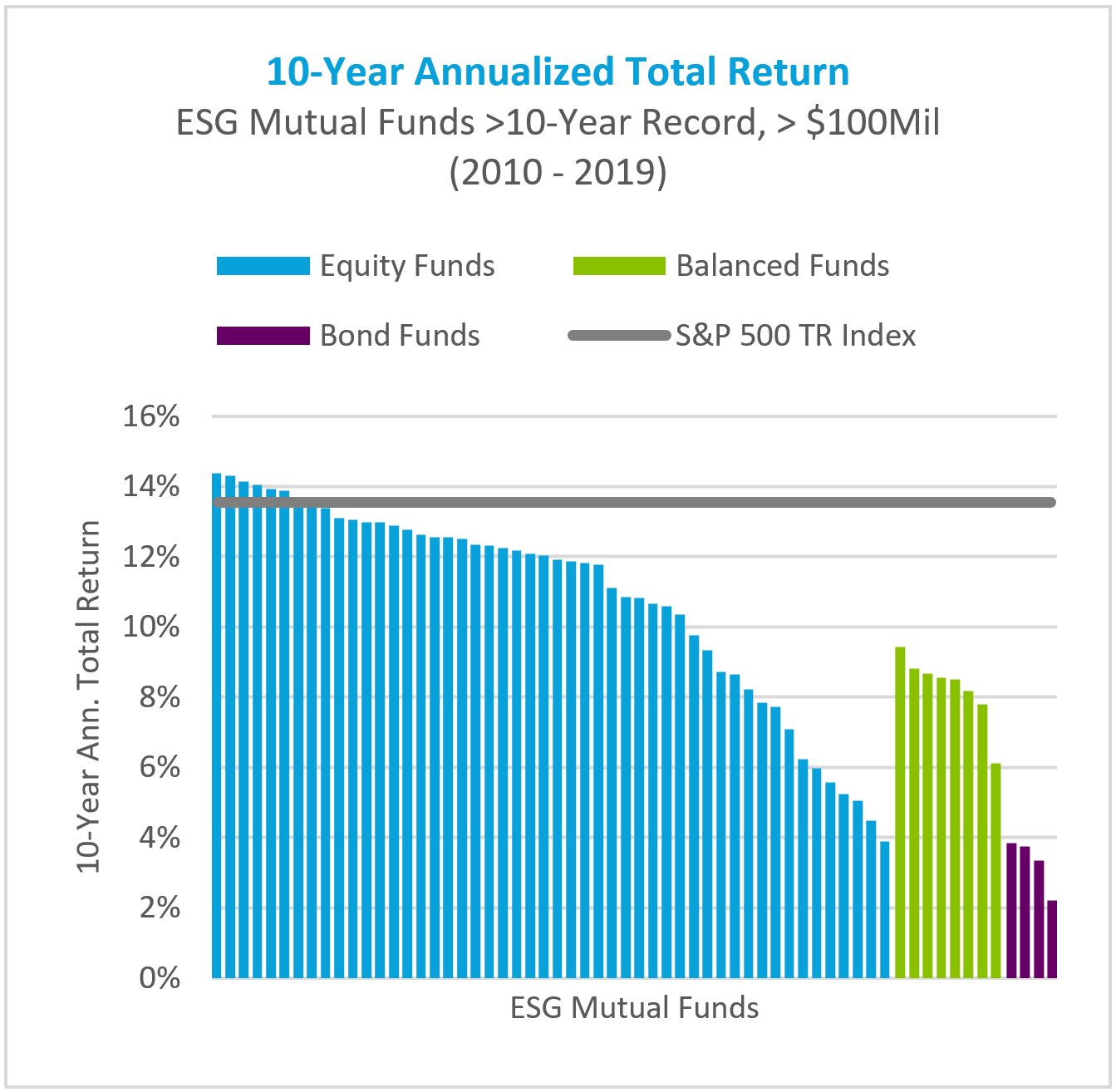

ESG investments have generally underperformed the market.

Our research shows that approximately 70% of all sustainable mutual fund and ETF assets represented by the 62 largest funds underperformed the broader market over the last decade – sometimes by a meaningful margin.

For more information on this research, see “Solving the ESG Dilemma: How to Advance One’s Values While Also Improving Performance.”

ESG investment return expectations will vary by investor. For some, near-market performance may be an acceptable trade-off in their pursuit of desired social or environmental change. Others may expect outperformance relative to benchmark. For all, fiduciary duty will weigh heavily and investment return consideration will be an important part of one’s decision.

Multi-asset ESG as envisioned by Welton has the potential to address some of these performance issues by taking a new approach:

- Multi-asset ESG portfolios may mitigate and diversify equity market systemic risk;

- Capital efficient allocation through the use of derivatives may improve return per unit of risk;

- Dynamic portfolio allocation enables adaptation to changing market conditions across myriad complementary ESG asset classes.

Multi-asset ESG represents an “all weather” approach that seeks to match the perpetual commitment of ESG itself.

As an all-equity investment today, one’s allocation to today’s ESG investment offerings must be modulated in accordance with market cycle risk and life stage. As an undiversified all-equity investment, ESG is a concentrated and risky investment.

It shouldn’t be this way. Why?

Investors deserve more because they view sustainable investing as a multi-generational commitment. The holding period of their ESG investments should match the eternal nature of their conviction.

The sustainable investing movement requires more to ensure unwavering investor support in order to accomplish the long-term sustainability goals sought. Over time, investor commitment to today’s single-asset ESG offerings may ebb and flow, falling in and out of favor with the markets themselves. This will be particularly true if ESG performance continues to lag benchmarks. Sustainable investing needs diversified offerings for long-term success.

ESG investors need investments with “all-weather” performance potential, investments worthy of earning a long-term static allocation within their portfolio. Multi-asset ESG as envisioned by Welton was designed to fill this need.

We’ve put these principles into action

Launched in June 2020, we created one of the industry’s first investable multi-asset ESG portfolios, Welton ESG Advantage. Combining decades of investing experience with innovation, we pioneered ESG scoring and portfolio construction techniques to bring Welton ESG Advantage to fruition.

To read more, see Institutional Investor’s article, “ESG Has Failed to Outperform for Years. Is this a Fix?” ESG Advantage was also recognized by ESG Investing, “Welton ESG Advantage Selected as Finalist for “Best ESG Investment Fund: Multi-Asset.”