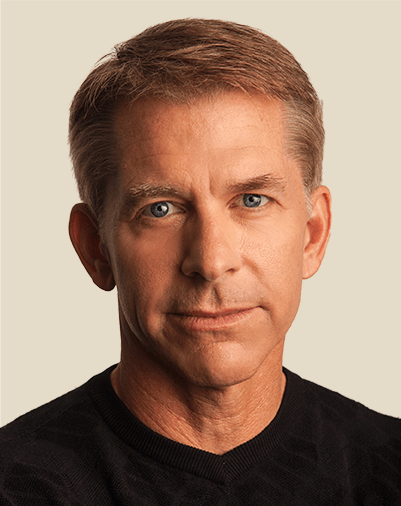

Dr. Patrick Welton

Founder & Chief Investment Officer

An active investor for more than three decades and an investment manager since 1989, Patrick co-founded Welton in 1988. As CIO, he oversees the investment team, develops and executes on investment strategies, and monitors compliance and risk associated with those activities. He also continues to support the firm’s research efforts.

Patrick has served on committees for the Managed Funds Association (MFA) and as a member of the Board of Directors of the National Futures Association (NFA). He speaks at numerous conferences globally every year, participates in panel presentations, and has authored numerous articles on alternative investments, macroeconomic impacts on markets, and investment theory. He’s the former Chair of the Board of Montage Health and its subsidiaries, the former Vice-Chair of the Panetta Institute of Public Policy and a member of their investment committees. In the late 1990s, he co-founded Axios Data Analysis, one of the first large-scale data analytics firms focused on healthcare. His research experience also includes molecular biological work in gene sequencing and biophysics with a focus on positron emission neurofunctional brain imaging, and oncology through clinical cancer trials during a nearly 20-year period as Clinical Professor at Stanford University Hospital. Patrick holds a BA from the University of Wisconsin-Madison. He also holds an MD from UCLA and completed his postdoctoral training at Stanford University. He additionally holds a certificate on Corporate Board Effectiveness from Harvard Business School.

“We are mindful of the real impacts of improving returns and lowering risks. We know foundations may grant more, endowments can support more, and retirees lives will be more secure.”

News and Insights from Dr. Patrick Welton

What Do Medical and Financial Research Have in Common? (Unfortunately). And, What Can You Do to Protect Yourself?

Regrettably, only a fraction of published medical research is reproducible by other investigators. This is no surprise to those of us who contribute or follow medical advancements. Hundreds of reviews have documented tens of thousands of examples. From cancer...

Seeking Protection from Inflationary Spikes? Some thoughts.

How might an investor protect themselves from the recent inflationary spike? How might they rationally act as the news is worsening? From a macroeconomic investor perspective, I offer caution in reacting to the news. The crescendo of news transmits multiple...

Why Covid Delta variant emergence may be positive for equities and bonds

B. G., Opalesque Geneva According to Dr. Pat Welton, founder and CIO of Welton Investment Partners, a U.S.-based quantitative and ESG hedge fund manager, the Covid Delta variant emergence is likely an intermediate-term positive for equities and bonds. On a related...