by Guillaume Detrait, President & Chief Risk Officer

[email protected]

During my 13-year tenure at Welton, I’ve overseen periods of growth, change, and the 2020 Covid pandemic crisis. And while each of these periods brought its own unique challenges, one organizational framework has recently helped us weather them all. That framework is known as Objectives and Key Results, or OKRs for short. I want to share our continuing experience to benefit those less familiar and to stimulate discussion with experienced OKR managers to advance learning for us all.

Management By Objective (MBO) – Where we began

Beginning in 2010, we formalized our managerial process around annual strategic planning cycles. We first identified a handful of firm-level goals for the new year. We then layered departmental goals toward their achievement – all consistent with a Management by Objective (or MBO for short) philosophy. We produced lengthy slide decks and held biannual multi-day meetings among senior staff. And while the formality and structure of the process seemed appropriate, actual goal achievement was admittedly mixed.

MBO begins to show its limitations

At some point, MBO proved less and less adequate as we started to scale the business and serve more clients. We had opened a New York office to be closer to many of our existing investors, which also imposed new bicoastal managerial responsibilities. We hired more staff, explored new product initiatives, expanded into new traded markets, and took on the incremental processes that come with greater institutionalization.

No initiative revealed our challenge more than our unmet goal to scale our in-house trading platform. Over the years, we evolved beyond our managed futures trading roots. We now possessed many codified investment strategies that were multistrategy and multi-asset in scope. And this strategy breadth was now imposing constant changes to our trading platform. Staff were increasingly spending time on maintenance which gave them less time for more impactful projects. Despite our earlier successes, MBO seemed inadequate when tackling these grander, longer cycle time, cross-departmental challenges.

Why OKRs?

Open to a change, in 2018 we evolved away from the MBO approach as we learned more about the Objectives and Key Results (OKR) model. OKR is a goal-setting framework that empowers staff to achieve overarching firm-level objectives by focusing on smaller related key results. Andy Grove, the former CEO of Intel, is famously credited as its first practitioner. Today, the OKR approach flourishes within successful Silicon Valley firms such as Google, Amazon, Adobe, Salesforce, Netflix, and of course, Intel. For those interested in learning more, I recommend John Doerr’s bestselling book, Measure What Matters.

Key tenants of the OKR framework

- Clear overarching corporate goals, served by underlying department goals and tasks

- Senior leaders establish 3-4 overarching firm goals.

- Department heads are empowered to set goals to advance their own departments and support the firm’s goals.

- The process ensures a unified collective effort toward firm objectives.

- Goal and activity setting

- Staff are empowered to propose activities that truly advance the enterprise, instilling ownership.

- Engages staff to think beyond day-to-day tasks.

- Stretch goals are encouraged but should be realistic too.

- Staff has the flexibility to add and adapt as necessary.

- Completion rates of about 70% are considered successful.

- OKRs are not tied directly to compensation.

- Short quarterly goal-setting cycles

- Bite-sized objectives and activities over brief 3-month cycles.

- It reflects the dynamism of the business where goals and circumstances must adapt often.

- Management can turn the entire organization on a dime and reprioritize projects to meet a near-term need.

- Frequent check-ins to course-correct and ensure progress

- All managers conduct weekly progress report meetings.

- Mid-quarter check-in meetings include all related cross-functional team members.

- Late quarter planning meetings occur to plot the next quarter’s OKRs.

- Absolute transparency

- All goals and real-time progress is available to all staff at all times.

- We use a cloud-based 3rd-party SaaS performance management platform to host, track and report all OKRs.

- Rather than recommend any single solution, I suggest beginning with a discriminating exploration of search results for “best OKR tracking software”.

Success stories

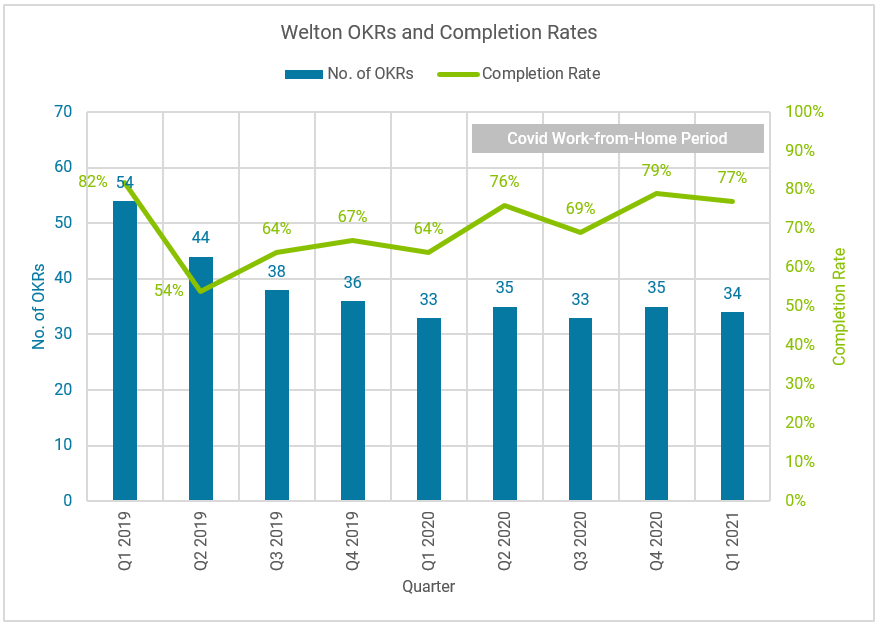

With nine quarters now logged since 2019, we have detailed logs of all objectives and completion rates. We have accomplished 300+ OKRs during this time with an average completion rate of 71%, matching the recommended completion rate of experienced practioners.

Our first success story deals with the elusive trading platform scaling challenge I shared earlier, a complex and long-term initiative. During our MBO period before 2018, each year we listed all of the in-house platform improvements we wanted to accomplish over the next 12 months. This yielded temporary gains but failed to push us toward the lasting solution we wanted. Under the OKR process, we instead committed first to the larger truth: our value to our investors lies in the development of our IP, not our back office and order management platform maintenance. Shorter quarterly planning cycles then enabled us to tackle smaller key results one at a time. Quarter 1 was spent evaluating the platform’s scalability potential and deciding if we should resolve in-house or outsource. Quarters 2 and 3 were spent evaluating outside vendors. Quarter 4 was spent choosing a vendor, and we are spending quarters 5 and 6 transitioning to a new and fully integrated 3rd-party front/middle and back office platform.

A second success story occurred in 2020 when we conceived of and launched one of the industry’s first multi-asset ESG programs in just two quarters. This achievement required multiple departmental teams to perform research, platform development, fund documentation, and marketing/sales support to secure seed funding for launch. It exemplifies the rapid cross-departmental responsiveness that is possible with the OKR structure. I credit the short quarterly planning cycles that rapidly shifted departmental priorities, weekly manager check-ins with staff to ensure progress toward goals, and full transparency between departments on their progress.

A third and final success story occurred in early 2021 with our new intraday trading strategies rollout. We aspired to develop these strategies for 2-3 years and finally realized that vision after just three dedicated quarters using the OKR process. Quarter 1 focused on infrastructure buildout to accommodate these shorter holding period strategies. Quarter 2 focused on implementation, and Quarter 3 was dedicated to rollout. I credit the OKR goal-setting process which constantly challenges staff to set bite-sized aspirational goals that go beyond the everyday.

Firm-level achievement since OKR adoption

Because I focus on ensuring consistent achievement across all departments, I have a unique vantage point into the effectiveness of the OKR method.

My scorecard appears here, and it encapsulates a number of valuable insights. Note that the turquoise bars represent the sum of all firm OKRs for the quarter, and the green line plots our firmwide achievement rate for these same OKRs.

Figure 1

Noteworthy items include:

- The first couple of quarters were an adjustment

- Notice that staff gave themselves a higher number of Objectives at the beginning (taller turquoise bars) than they did later.

- Completion rates (green line) were also volatile during these first few quarters.

- Six months later, staff got the hang of things

- Sum of all goals (bars) now consistently settles ~35 per quarter.

- Completion rates (line) have increased over time, my most hoped-for trend as a measure of firmwide execution.

- Regarding this upward sloping achievement line, we’re fortunate that our staff tend to be the over-achieving type, so I’m not entirely surprised by this adherence and commitment. (Perhaps this is observed by other OKR adherents too?) For example, one of the merits of the OKR process is the degree of ownership that staff feel for their chosen goals.

- Our completion rates rose throughout the Covid-19 home quarantine period between Q2 2020 and Q1 2021.

- These results challenge conventional thinking about likely work-from-home efficiency. This was a pleasant and welcome confirmation of course, and another reflection we think of the firm’s over-achieving and pride of work culture.

- While this last point is not depicted above in the chart, I believe the OKR process has enhanced collegiality and a sense of shared purpose among staff.

- With the right firm culture, I believe the OKR process can foster camaraderie among staff. Because OKR achievement is now a shared priority among all staff, we’ve found that colleagues are always willing to help others achieve their goals.

Conclusion

The adoption of OKRs as a foundational part of our management approach has played a vital role in our success and would likely benefit other asset managers as well. Our industry is highly competitive, investors are rightfully demanding, and firm operations are increasingly complex while internal resources are often constrained. Firms like ours demand optimized efficiency and focus for success, and we found the OKR framework provides the requisite structure and motivation to help us in these endeavors. It has enabled us to capitalize on near-term opportunities and adapt to environmental shocks such as Covid-19 better than we could have previously.