Welton Trend

Systematic Trend

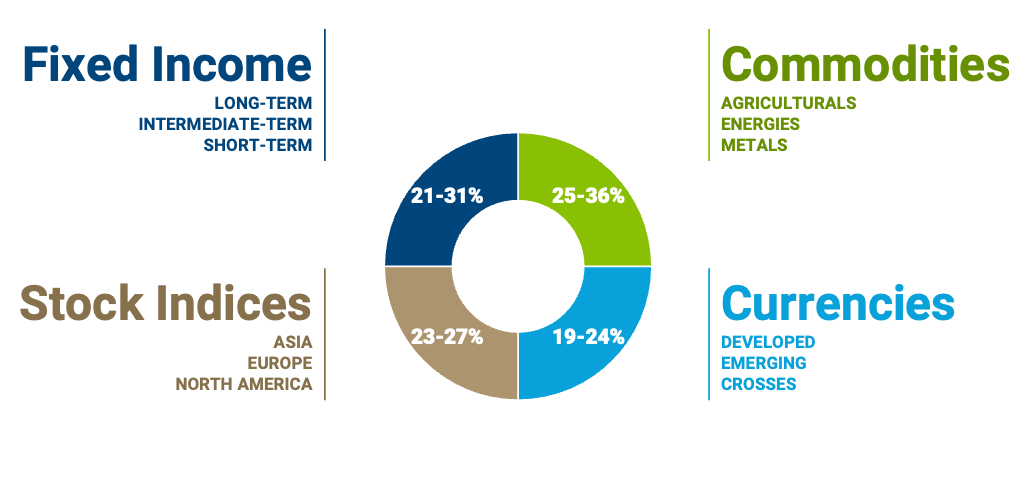

Welton Trend, the firm’s systematic trend program, seeks to reliably deliver index-beating returns that are uncorrelated to the major equity and credit market indices. It trades a diversified group of highly liquid global markets including fixed income, equity indices, commodities and currencies.

Welton Trend seeks to deliver:

- Annualized returns greater than 2% over broad CTA indices over an investment cycle

- Low correlation to broad equity and credit markets

- Equity bear market performance

Curious About Our Performance?

Complete the form to receive a current fact sheet via email.

Care to Learn More?

Complete the form and we’ll be glad to answer your questions and/or arrange a time to speak.

Welton Investment Philosophy

We believe that focusing on a portfolio of recurrent market events, harnessing well-researched team insights, and applying rigorously tested mathematical models, leads to superior absolute return opportunities fit for all market environments.

What We Invest In

Four asset classes selected to cover global macroeconomic return sources using over 50 liquid, objectively-valued, and well-regulated markets.

Pie chart reflects actively traded markets and gross sector allocations as a percentage of total targeted portfolio volatility. Range of risk budgets is based on actual historical data and is included for illustrative purposes only. The characteristics of the program(s) described in this material are sought during the portfolio management process. Actual experience may not reflect all these characteristics or may be outside of stated ranges.

How We Capture Returns

Two Strategy Groups

Long and short positions that seek returns from longer term economically-driven and fundamental market changes across asset classes

Multiple Trend identification methods

Rigorous domain experience supports top quartile results

Allocation Range: 50% each

Enhanced Trend

- Utilizes sector relevant macro economic and financial drivers as inputs to seek better risk- adjusted returns

Trend

- Uses price signals to identify both economically driven and divergent market trends covering diverse economic conditions

Allocation ranges stated above reflect strategy group allocations as a percentage of total targeted portfolio volatility. The characteristics of the program(s) described in this material are sought during the portfolio management process. Actual experience may not reflect all these characteristics or may be outside of stated ranges.

Curious About Our Performance?

Complete the form to receive a current fact sheet via email.

Care to Learn More?

Complete the form and we’ll be glad to answer your questions and/or arrange a time to speak.