Our Team

Purposeful and passionate

Inquisitive problem solvers working for you

We’re passionate about combining data-driven financial insights with science, mathematics, and economics to address your most complex investment challenges.

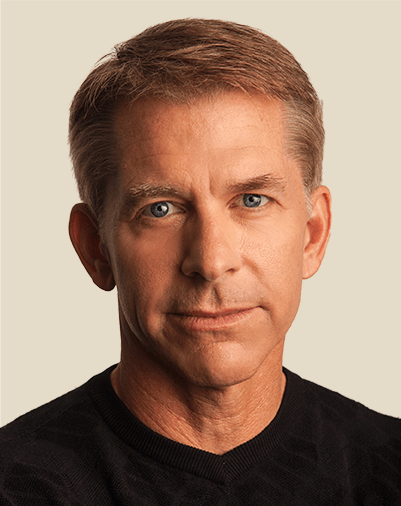

Dr. Patrick Welton

Founder & Chief Investment Officer

Guillaume Detrait

President & Chief Risk Officer

Todd Merrell, CPA, CA

Chief Financial Officer

Emily Fry, CAIA

Head of Trading Operations & Oversight

Alexandra Burke

Head of Software Engineering

Dr. Oren Rosen, PhD, CAIA

Senior Portfolio Manager, Systematic Macro & Trend Strategies

Dr. François Chevallier-Gravezat, PhD

Senior Research Strategist, Machine Learning Strategies

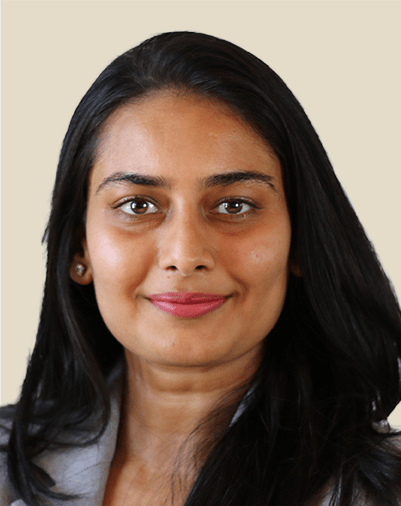

Purva Chhabra, CFA, CAIA

Junior Research Strategist, Systematic Macro & Trend Strategies, and Trader

Adam Roach, CAIA

Senior Quantitative Developer and Research Strategist

Matthieu Claudel

Senior Research Strategist, Systematic Macro & Machine Learning Strategies

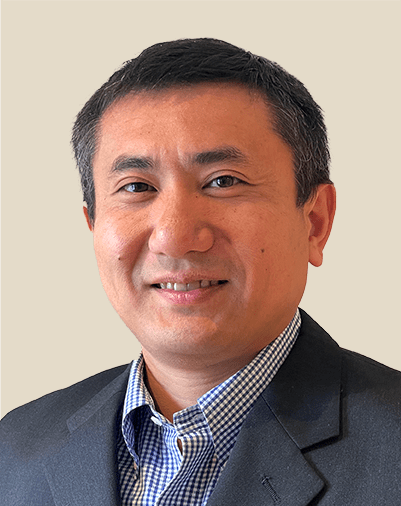

Rushui Guan

Senior Software Architect and Quantitative Developer

Fiona Wu

Senior Software Engineer

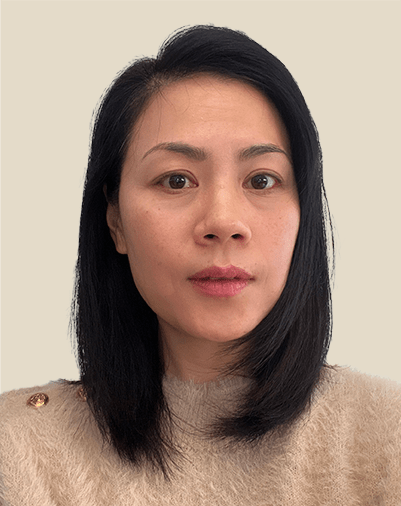

Katie He

Junior Portfolio Manager, Machine Learning Strategies

Sion Daniel

Junior Quantitative Analyst and Trader

Christopher Keenan

Director of Marketing

William Marr

Head of Business Growth

Scott H. Merkel, CFA

Senior Managing Director, Portfolio Solutions

Sebastian E. “Sam” Cassetta

Senior Managing Director, International

David Nowlin, CRCP

Chief Compliance Officer

Daniel Gallagher

Head of Operations and Investor Services

Hunter Leighton

Chief Information Security Officer and Head of Infrastructure

Debbie Pyles

Senior Associate, Accounting

Board of Directors

Annette Welton

Board Chair

Don Putnam

Board Member

Mel Lindsey, CFA

Board Observer

Arthur F. Bell, Jr., CPA

Board Member

Guillaume Detrait

Board Member

Dr. Patrick Welton

Board Member