Event has passed, however, presentation is available by request to: [email protected].

Date:

Wednesday, June 10, 2020

Location:

Virtual

Agenda:

08:00 – 08:10AM Welcome and Opening Remarks

Marko Kolanovic – Global Head of Macro Quantitative & Derivatives Strategy, J.P. Morgan

Dubravko Lakos – Head of Equity Strategy & Quant Research, J.P. Morgan

08:10 – 09:20AM Keynote Presentation and Discussion

Nassim Nicholas Taleb – Renowned Author, Researcher, and Scientific Advisor to Universa Investments

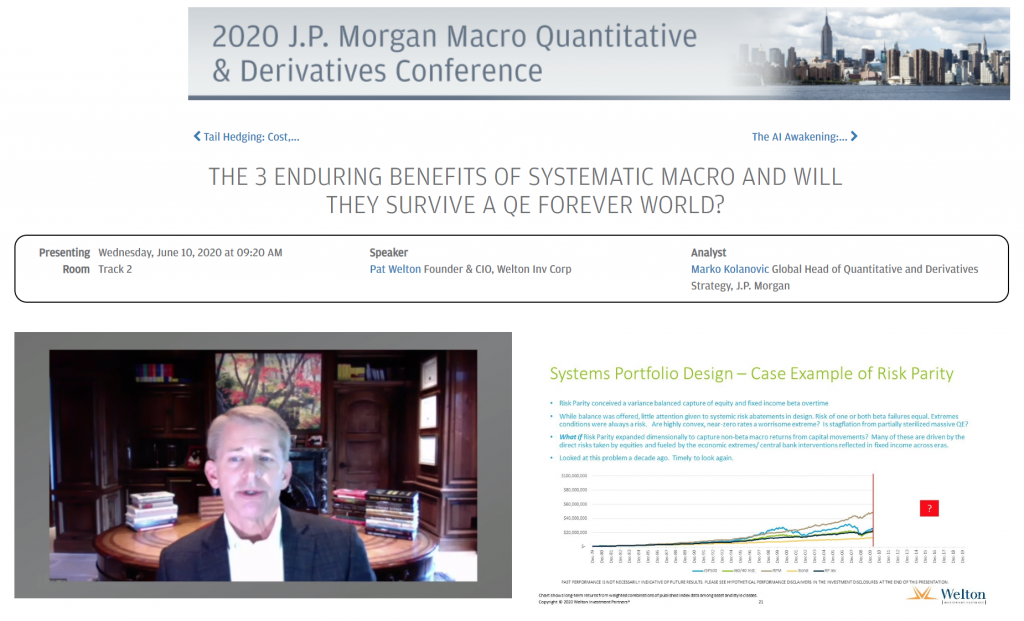

09:20 – 09:50AM The 3 Enduring Benefits of Systematic Macro; Will They Survive a QE Forever World?

Pat Welton – Founder and CIO, Welton

09:50 – 10:20AM Tail Hedging: Cost, Reliability, Decay and the Need for Diversification

Roxton McNeal – Director, Head of Multi-Asset Investment Strategy & Allocation, UPS Pension

10:20 – 10:50AM Weathering Covid-Crisis Turbulence – Multi-Strategy Fund Approach

Marc-André Soublière – Senior VP Fixed Income and Derivatives, Trans-Canada Capital

10:50 – 11:20AM Breakout Sessions & Networking

11:20 – 11:50AM The AI Awakening: Implications for the Economy and Investors

Erik Brynjolfsson – Professor, Director of Digital Economy Lab, Stanford

11:50 – 12:40PM Big Data Panel: Alternative Data in Investing During COVID-19 Crisis

Founders/CEOs of Bogan Associates, QuantCube, Ravenpack, 1010 Data

Moderated by: Peng Cheng, Macro Quantitative & Derivatives Strategy, J.P. Morgan

12:40 – 01:00PM Investors Survey on Market, Quant & Alternative Data Survery

Conducted by: Dubravko Lakos, Head of Equity Strategy & Quant Research, J.P. Morgan

01:00 – 01:30PM ARP Risk Management – Theory vs Practice

Matthew Schwab & Federico Gilly – Co-Heads of Research, Portfolio Management and Portfolio Construction for Alternative Investment Strategies, GSAM

01:30 – 02:00PM Intangible Capital and the Value Factor: Has Your Value Definition Just Expired?

Felix Goltz – Research Director, Member EDHEC Research Chair, Scientific Beta

02:00 – 02:30PM Breakout Sessions & Networking

02:30 – 03:00PM Investing in Risk Premia in the Face of Increasing Uncertainty

Kazuhiro Shimbo – CIO, Quantitative Strategies, AM One

03:00 – 03:30PM Antifragile Currencies

Gustavo Soares – Asset Allocation Team, BWGI

03:30 – 04:15 PM Afternoon Keynote Presentation

Sandy Rattray – CEO/CIO, Man AHL

Interviewed by Marko Kolanovic – Global Head of Macro Quantitative & Derivatives Strategy, J.P. Morgan

04:15 – 04:30 PM Closing Remarks