Dr. Patrick Welton Founder and Chief Investment Officer [email protected]

How might an investor protect themselves from the recent inflationary spike? How might they rationally act as the news is worsening?

From a macroeconomic investor perspective, I offer caution in reacting to the news. The crescendo of news transmits multiple signals. Carrying both information and urgency, the news feeds behavioral tendencies. Investors can easily be lured into actions driven by the urgency, ultimately losing the return advantage embedded in the information.

Short-term inflation is no doubt a problem. The massive shift in consumer preferences from services to goods simultaneous with global liquidity injections has snarled the supply side. Disruptions and capacity mismatches are everywhere and well-noted. But how should that affect an investor?

Investors ultimately seek capital productivity. And by nature, disruptions offer opportunities. Tactically, this will open doors in areas as diverse as energy, transportation, information, and more … but tactically.

So how does the long-term guide us? I offer two perspectives for investors to watch.

The first is the character of supply-side disruptions. They classically cause aggregate supply and demand curves to intersect at higher price levels but lower levels of real GDP. Without new liquidity, potential forward growth drops. They are a burden, not an accelerant.

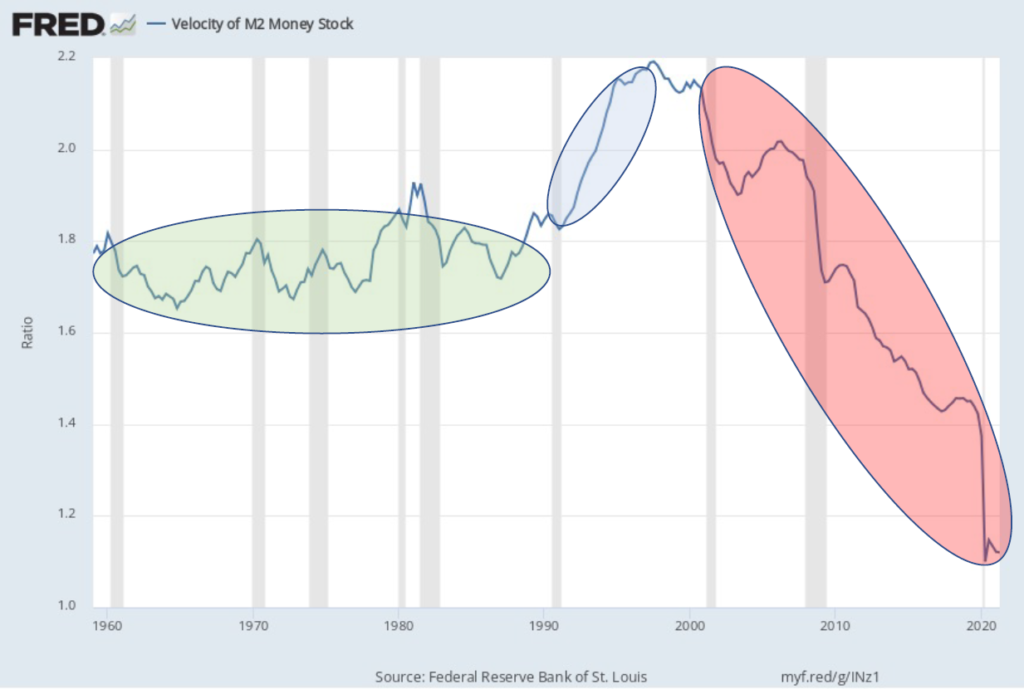

Second, any new liquidity through money and debt creation has steadily become less efficient. Look at the attached graph from FRED with a few color regimes I added. After nearly 30 years of relatively stable velocity (green) and a short period with decreasing debt accumulation in the 1990s allowing a rise in velocity (blue), the US has had a precipitous fall in velocity for 20 years.

Note each sharp downward acceleration with successive QE regimens. The decline in velocity is indicative of an increased money supply blockaded in the financial system. Without the new debt productively generating a net positive total income, investors must account for future growth that is ever smaller. Absent new information, such as steady traction in rising velocity and rising money supply, then the current information is an investor’s most probable guide.

Regrettably, longer-term investor allocations need to be prepared for slowing growth next year and beyond and all that it implies.