B. G., Opalesque Geneva

Dr. Patrick Welton Founder and Chief Investment Officer [email protected]

According to Dr. Pat Welton, founder and CIO of Welton Investment Partners, a U.S.-based quantitative and ESG hedge fund manager, the Covid Delta variant emergence is likely an intermediate-term positive for equities and bonds. On a related matter, even though market reactions are often attributed to new data and announcements, he says, market reactions should be attributed to impact from investors. He explains why in this interview.

Opalesque: You say the Delta variant emergence is likely positive for equity and bonds. Could you explain?

Dr. Pat Welton: As a medical doctor and former medical faculty, I follow news on the Delta variant very closely. It is the latest widespread variant in a series of variants that have occurred and will continue to mutate with the Coronavirus. The medical and economic problem is its increased infectivity. Its very high R-naught value is propelling its sweep through so many countries, both unvaccinated and partially vaccinated.

From an investor standpoint, I believe its prevalence has two principal impacts on the potential valuation of assets.

The first is the direct economic impact. Depending on how fast Delta spreads, it will induce declines in economic activity in some sectors, and concentration or buttressing of economic activity elsewhere. A simple analysis might be lower travel rates and increased work-from-home, but it is always far more complicated than that. For a global investor, this is a very western and developed economic country viewpoint. In other economies with differing structures and public health policy approaches, direct market impacts will vary considerably.

Opalesque: What is the second impact?

PW: The second impact is through rising uncertainty. Anytime uncertainty is raised, versus specific economic effects, it creates expectation changes for the Fed, its impact on the size, speed, and scope of Fed policy, and upon other central banks. This is a cornerstone input to market reaction. Specifically, current market pricing has factored in the expectations for when the Fed’s rate changes will occur and how it may modify QE purchases. Every weighted possibility has already been factored into the aggregate purchases and sales through positioning in the market. Something that increases uncertainty and potentially changes economic activity only forces to delay policy change.

Whether we have one more month, three more months, six more months of QE, much of that money will fuel asset price inflation. A lot of that money does not end up making it into the real economy. You can see that in the drops of the money velocity. It is very profound. You can see that through the sharp decline in loan to deposit ratios. The direct purchase of assets with QE money ends up in redeployment to assets supporting price.

As terrible as it is from a public health standpoint, the net effect of Delta, for many investors in aggregate, is that it tends to price in expectations of a delay in normalization of monetary policy or a decline of QE. Continued central bank accommodation supports asset prices.

Opalesque: Talking of market reactions, you say they are often attributed to new data and announcements, whereas they should be attributed to investors moving capital. Could you elaborate?

PW: When investors read and see market stories, it is easier for them to understand the market stories as though it is data that directly moves the markets. For example, a report from the CPI says that because inflation went down, up, or sideways, the market rose or fell. This intellectual shortcut is sometimes worth unpacking to be a more successful trader: the report itself did not do anything. The economic story has no direct linkage to asset pricing. The data was read and understood by investors, who then had an analytic choice of whether to change their market positions. The change of market position creates an incremental flow of capital from one asset to another. If everyone read a report, whatever report we exemplify, and did nothing, the report would have no impact – even if the contents were startling.

It is a subtle difference to some people. It is an enormous difference in how capital markets work overtime. This indirect linkage changes. Sometimes, the very same report has compelling meaning to investors, and they react to it. In other contexts, they may not.

Opalesque: Why do you think this is an important point?

PW: I bring up the point because it changes over time. This manifests in different ways. You hear traders sometimes say, “we’re in a different market regime,” or “in a different mood,” or “in a different cycle.” That is, during this period, investors are reacting in a specific direction or magnitude. And then they react differently. For example, investors’ reactivity often dampens to similar amplitudes of news changes. Commonly, investors observe this when equities sell off following a shocking piece of news, and a week or two later, an equally shocking piece of news comes out, and they sell off far less. That’s because a lot of that money has already moved. The incremental difference of net capital sold per unit of time has declined. The interesting question and one source of analytic investment edge, of course, is probing why.

Opalesque: What is the mood today?

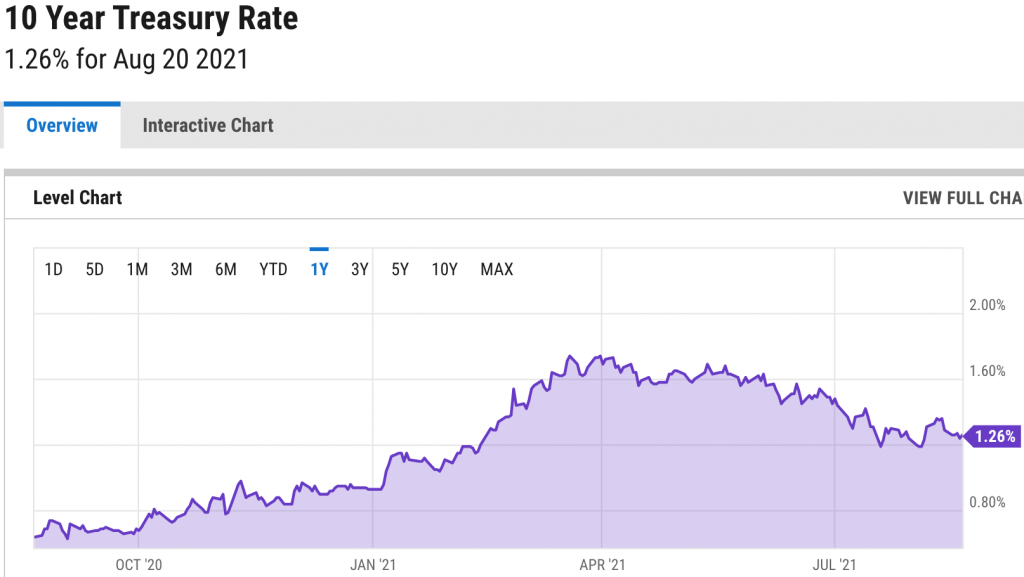

PW: A few months ago, yields were climbing and reached levels of over 1.7% – using the U.S. 10-year as an example. The entire yield curve climbed. If one were to read almost anything at the time, the financial press narrative was how fast yields would climb. Inflation was at hand and rising. A fear that investors and the media amplified. Abruptly, in early May, long before any definitive data changed, yields began changing course. By August, 10-year Treasury notes moved to 1.3%. The drop is partly because new information came in the marketplace but more forcefully because the linkage of investor capital decisions strongly changed.

The move defied prediction expectations because this linkage is contextual and complex. And though unpredicted, it was not a surprise for sophisticated capital market investors. Sophisticated investors understand they always deploy capital into a cloud of probability. In this view, the vast majority of probabilities indicated rates would rise, but it also accommodated for a likelihood of decline. That is the weighing machine of the marketplace.

Source: Ycharts.com

Opalesque: What about from the fund manager’s (such as yourself) standpoint?

PW: We always look at the forward potential of the market in a probabilistic way. We may center on a direction, but we incorporate multiple horizons of possibility that the market could move faster in the same direction, move slower, revert to move in the opposite direction, or not move at all. We include strategies that would have the potential to capture all of those probabilities. Their weighting waxes and wanes as the market capital flows unfold. That is fundamental to our style.

In contrast, there are other managers that try to be as precise as possible with their forecast conviction and then go all in – only changing their minds when their confidence dictates. Both styles can work. The disciplined application drives effectiveness.

(Article reprinted with permission from Opalesque).