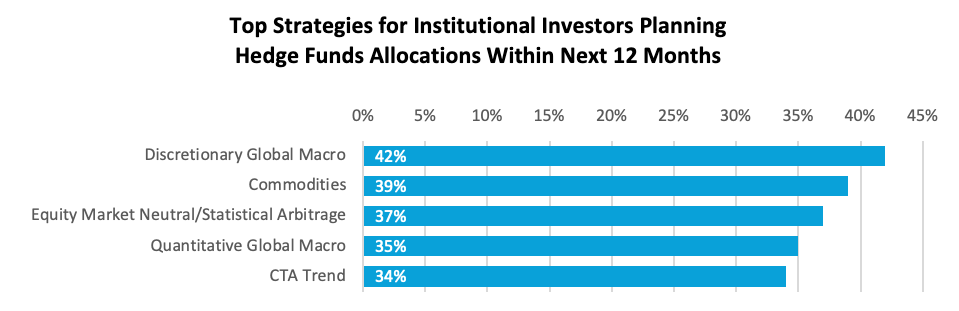

Institutional investors have spoken: Global Macro remains at the top of the hedge fund allocation list for 20251

A recent Sociétè Generale survey of institutional allocators confirms that 40%+ of institutions plan to increase their exposure to global macro strategies in the next 12 months.2 What is driving this interest?

The answer lies in a changing market landscape. Rising macroeconomic and geopolitical uncertainty, diverging global policy paths, and the erosion of traditional diversification approaches have created a fertile environment for macro strategies. Institutional investors recognize that 2025 may be a pivotal year—one where macro’s flexibility and opportunistic approach might benefit portfolios.

Notably, macro-related strategies represented four of the top five allocation priorities in the SocGen survey, including discretionary and quantitative global macro, commodities, and CTA trend-following:

Source3

Why Institutional Investors Are Considering Global Macro Strategies

1) Diversification in a Shifting Market

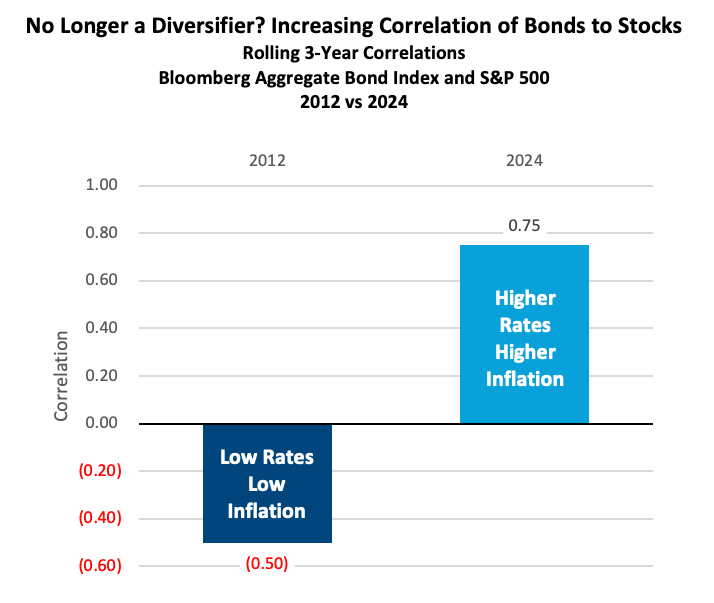

For years, many investors relied on the 60/40 stock-bond portfolio as a core diversification framework. However, the investment landscape has changed.

-

- Rising rates, inflation, and shifting central bank policies have upended the traditional diversification model.

- Bonds, once a reliable counterbalance to equities, often decline in tandem with stocks.

- Periods of higher inflation4 and interest rate volatility5 have historically increased stock-bond correlation, challenging traditional diversification models.

- Investors need uncorrelated strategies that can adapt across asset classes.

Source6

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

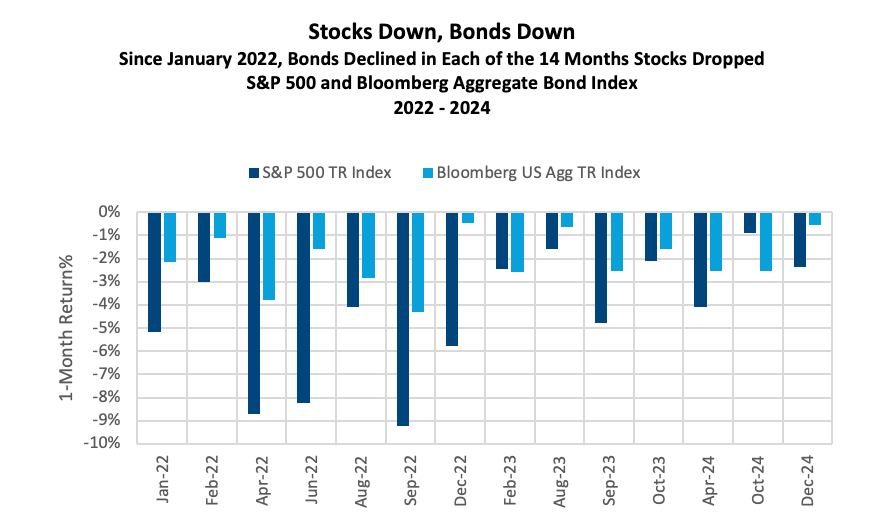

Not only have bonds recently been correlated to stocks, the Bloomberg Aggregate Bond Index has also posted negative returns in each of the 14 down months for the S&P 500 since January 2022. Bonds can no longer be relied upon to act as a buffer when stocks drop.

Source7

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

With a long history of uncorrelated returns, institutions are rediscovering global macro strategies.

2) Interest Rate and Policy Divergence

Global monetary policy is no longer synchronized. Instead, policy fragmentation is creating distinct macro trading opportunities:

-

- U.S. Federal Reserve: Maintaining a cautious stance on interest rates, but mindful of inflation pressures.

- European Central Bank: Implementing measured rate cuts to support economic growth.

- Bank of Japan: After exiting negative rates, currency interventions are sending ripples across global markets.

For macro investors, these interest rate differentials present long and short opportunities across currencies, interest rates, commodities, and equities—gaps that traditional long-only strategies may not effectively capture.

3) Market Dislocations and Tactical Opportunities

The current environment is characterized by uncertainty:

-

- Inflation, interest rates, and fiscal policy remain key areas of focus.

- Trade realignments and geopolitical risks are reshaping global markets.

- With elections scheduled in multiple regions in 2025, policy uncertainty is elevated.

Who are the managers who can navigate this market environment?

Some investors view macro strategies as a way to capitalize on dislocations, seeking opportunities in volatility and structural shifts. Most investment styles try to avoid risks, but in the macro world, experienced managers embrace them—analyzing and positioning around macroeconomic uncertainties as potential sources of return, with an emphasis on disciplined risk management.

As a recent Reuters headline put it:

“Macro a must-have for hedge fund investors betting on 2025 market swings.” 8

Historic Resilience

1) Potential Outperformance During Market Turmoil

Historical data shows that macro-oriented strategies have delivered positive returns in multiple periods of market stress.

-

- Macro strategies provided positive returns in the prolonged equity bear markets of the Great Financial Crisis (2007-2009) and Tech Bust (2000-2002).9

- A study by iCapital found that during the 2022 market downturn, macro hedge funds generated positive returns in 7 out of 10 months when both stocks and bonds declined.10

- These results illustrate the potential for macro strategies to act as a stabilizing component within a broader portfolio.

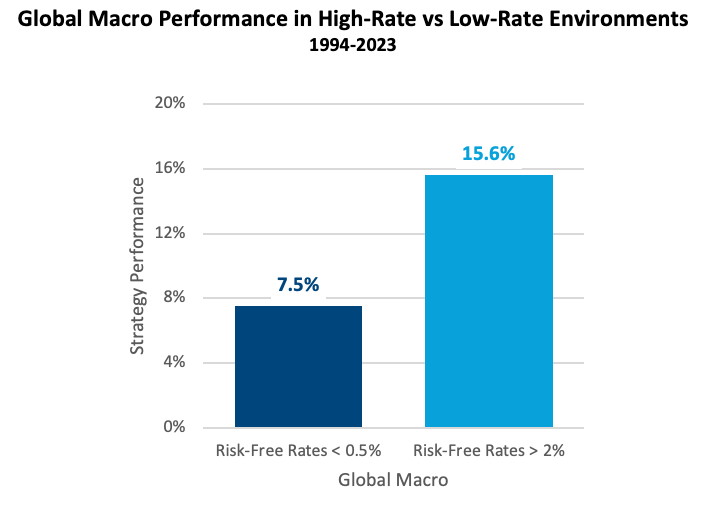

2) Higher Rates May Enhance Returns

Beyond trading profits, macro strategies can capitalize on high rates through enhanced carry.

-

- Many macro managers implement positions using futures and derivatives, requiring limited capital outlay for margin.

- The remaining capital is often held in short-term investments, such as 3-month Treasury Bills, that benefit from higher interest rates.

- The result: capital efficiency that can enhance investor returns in a higher-rate environment.

3) Potential Profit Sources Combined

Global macro strategies can provide a combination of potential trading profits as well as income from carry. In higher interest rate environments, this combination can produce excess returns.

According to iCapital and BlackRock research, global macro strategies have historically demonstrated strength amidst higher rates:

Source11

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

2025: A Pivotal Year for Global Macro?

1) Geopolitical Risks and Market Volatility

2025 is already a year of elevated uncertainty. Global elections, shifting U.S. policy priorities, regional conflicts, and ongoing trade realignments may increase volatility across asset classes. For macro investors, this backdrop creates opportunities across currencies, interest rates, equities, and commodities.

2) Evolution of Diversification

When stocks and bonds move in the same direction, the traditional diversification playbook is no longer effective.

-

- Investors are evaluating alternative strategies with uncorrelated return potential.

- Investors need alternative return sources that can add defense by lowering portfolio volatility and drawdowns —macro-oriented strategies may offer just that.

- In multiple historical scenarios, macro has provided non-correlated, positive returns when traditional and risk assets struggled.

3) Institutional Allocators and Global Macro

Large institutional investors, including pension funds, endowments, and family offices, are adjusting their allocations to reflect evolving market conditions.

-

- Major pension systems like the California and Ohio Public Employee Retirement Systems (CalPERS and OPERS) are shifting into diversified risk-mitigation strategies, including macro and trend following, after high profile exits.12

- According to Pension & Investments, OPERS Chief Investment Officer Paul Greff wrote in a recent memo that growth assets need to be “accompanied by a stabilizing allocation to risk-mitigating strategies to reduce the volatility.”

This institutional backing underscores macro’s potential role as an integral—not peripheral—allocation in sophisticated portfolios.

Risk and the Importance of Manager Selection

Global macro strategies offer diverse approaches, but investor success depends on selecting managers with the experience, execution capability, and risk controls to navigate complex markets. Wide dispersion in performance among macro funds makes manager selection critical.

-

- Diverse Approaches, Varied Outcomes – Macro managers differ significantly in strategy, asset class focus, and risk tolerance. Some rely on discretionary views, others on systematic models, and each approach responds differently to shifting market conditions.

- Timing and Execution Matter – While macro strategies aim to capitalize on economic trends, incorrect positioning or unexpected market shifts can lead to losses.

- Liquidity and Cash Efficiency – The best macro managers focus on liquid markets and capital efficiency, using leverage prudently to optimize risk-adjusted returns.

- Risk Management is Key – Effective macro managers diversify across asset classes and geographies, reducing reliance on a single market driver. Managers must defend against adverse results, and investors must identify those managers with robust risk management.

Given the wide range of outcomes in macro investing, manager selection is crucial. Investors should evaluate experience, risk controls, and diversification across markets to ensure their macro allocations align with their broader portfolio objectives.

A Leading Choice

Institutional investors recognize that 2025 will demand an updated approach to creating resilient portfolios. With traditional diversification undermined and market uncertainty rising, global macro offers a potential combination of adaptability, uncorrelated returns, and opportunistic positioning.

For financial advisors and investors seeking strategies with the potential to profit in a changing world, global macro should be considered for a core allocation in 2025 and beyond.

+ + +

1 Nell Mackenzie, Carolina Mandl, and Summer Zhen ,“Macro a must-have for hedge fund investors betting on 2025 market swings”, Reuters, December 18, 2024.

2 David Regan, “SG Prime: Fall 2024 Investor Sentiment Report”, Societe Generale, November 2024.

3 Societe Generale Institutional Survey, November 2024.

4 Maria Nikitanova and Dane Smith, “The Global Trend of Positive Stock/Bond Correlation,” State Street Global Advisors, December 23, 2024.

5 Samuel Zief, “Navigating the new year: 3 resolutions for investors,” JPMorgan, January 10, 2025.

6 Maria Nikitanova and Dane Smith, “The Global Trend of Positive Stock/Bond Correlation,” State Street Global Advisors, December 23, 2024.

7 Welton Investment Partners.

8 Nell Mackenzie, Carolina Mandl, and Summer Zhen, “Macro a must-have for hedge fund investors betting on 2025 market swings,” Reuters, December 18, 2024.

9 Graham Capital Management, “Building Portfolio Resilience at the Macro Level,” January 2023.

10 Joseph Burns, “Macro Hedge Funds: Zigging When the Markets Zag,” iCapital, October 19, 2023.

11 BlackRock, “Hedge Fund Opportunities in a Rising Rates and Uncertain Market Environment,” August 2023. Global Macro performance represented by the Credit Suisse Global Macro Index.

12 With Intelligence, “Hedge Fund Outlook 2025,” January 2025, p. 3.

THE OPINIONS EXPRESSED ARE THOSE OF THE AUTHOR OR THE INDIVIDUAL TO WHOM THE STATEMENTS ARE ATTRIBUTED. WHILE BELIEVED TO BE REASONABLY BASED ON FACT AND INQUIRY, THERE CAN BE NO GUARANTEES THAT SUCH OUTCOMES EXPRESSED OR IMPLIED HAVE OCCURRED OR WILL INDEED OCCUR.

THIS DOCUMENT IS NOT A SOLICITATION FOR INVESTMENT. SUCH INVESTMENT IS ONLY OFFERED ON THE BASIS OF INFORMATION AND REPRESENTATIONS MADE IN THE APPROPRIATE OFFERING DOCUMENTATION. ANY INVESTMENT PROGRAM DESCRIBED HEREIN IS SPECULATIVE, INVOLVES SUBSTANTIAL RISK AND IS NOT SUITABLE FOR ALL INVESTORS. NO REPRESENTATION IS BEING MADE THAT ANY INVESTOR WILL OR IS LIKELY TO ACHIEVE SIMILAR RESULTS.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.