Since early 2022, U.S. equities have experienced negative monthly returns in 17 separate months. Bonds declined in all but three of them. This pattern has led many investors and advisors to question whether the traditional 60/40 portfolio is still capable of delivering the stability and diversification it once promised.

Today’s global investing environment is characterized by increased volatility, policy shifts, geopolitical disruptions, and unpredictable movements in inflation, interest rates, and currencies. These forces have unsettled longstanding assumptions and introduced new challenges to asset allocation. In this context, diversification—executed thoughtfully—remains a central tenet of portfolio construction.

What Today’s Markets Are Telling Us About Diversification

Diversification has long been a foundational principle in portfolio construction, providing investors with a disciplined framework for managing uncertainty. The goal is not merely to spread risk, but to build resilient, all-weather portfolios that can endure a range of economic scenarios and market regimes while pursuing long-term objectives.

In recent years, however, the effectiveness of diversification has been called into question—particularly when it is implemented through a conventional pairing of equities and bonds. In our view, the current investment landscape—defined by elevated macroeconomic volatility and unstable asset correlations—compels a fresh evaluation of how diversification is applied.

This inquiry is not theoretical. The recent “Tariff Tantrum,” a sharp selloff triggered by escalating trade tensions, offered a vivid reminder of how quickly market regimes can shift. Events such as this underscore the importance of reassessing the composition and construction of diversified portfolios.

Four Timeless Advantages of Diversification

4 Reasons to Diversify

|

Despite periodic reassessment, diversification continues to offer lasting advantages:

About Alternative Insights

Get exclusive market insights and expert perspectives on key trends and opportunities to help you navigate the ever-changing financial landscape with confidence.

1) The Only “Free Lunch” in Investing

The principle of diversification has often been described as the only “free lunch” in investing, a phrase attributed to Nobel Laureate Harry Markowitz. In his groundbreaking 1952 paper Portfolio Selection, Markowitz laid the foundation for modern portfolio theory, emphasizing that investors seek efficient combinations of risk and return.

“Diversification is both observed and sensible,” he wrote. “A rule of behavior which does not imply the superiority of diversification must be rejected.”1

This insight has become a cornerstone of institutional investing. As Markowitz explained in his Nobel biography:

“Investors diversify because they are concerned with risk as well as return… It is natural to assume that investors selected from the set of optimal risk-return combinations.” 2

The core idea remains as powerful today as it was then: by combining assets with imperfect correlations, investors can reduce overall risk without necessarily reducing return.

“The core idea of Markowitz’ Nobel Prize winning insight remains powerful: by combining assets with imperfect correlations, investors can reduce overall risk without necessarily reducing return.”

2) Downside Risk Mitigation

Diversification may not eliminate losses entirely, but it can reduce their severity. Historically, diversified portfolios have experienced smaller drawdowns and faster recoveries during periods of market stress.

3) Enhanced Risk-Adjusted Returns

By reducing volatility, diversification has the potential to improve a portfolio’s Sharpe ratio, offering a more efficient balance of risk and return. This becomes increasingly important in environments characterized by lower expected equity returns and higher uncertainty. However, low correlation alone is insufficient—diversification must be accompanied by thoughtful asset selection and weighting.

4) Improved Access and Implementation

In today’s marketplace, diversification is more accessible than ever. The rise of ETFs, model portfolios, and digital platforms allows investors to gain exposure to a broad array of asset classes—including equities, fixed income, commodities, and alternatives from across the liquidity spectrum—once available only to institutions or ultra-high-net-worth investors.

Four Common Criticisms of Diversification

4 Criticisms of Diversification

|

Despite its long-standing role, diversification faces increasing scrutiny—particularly in light of recent market dynamics:

1) Underperformance During Bull Markets

Diversified portfolios may underperform concentrated equity benchmarks during strong bull markets. This can lead to performance regret, especially when market gains are driven by a narrow group of high-performing stocks. Advisors may find it challenging to justify diversification when clients see headline-grabbing returns from index-focused or momentum-driven strategies.

Professor Markowitz would urge such investors to stay the course and maintain their commitment to “investment as distinguished from speculative behavior…the propensity to gamble.” 3

2) Limited Protection During Recent Bear Markets

In the equity market drawdowns of recent years, traditional diversifiers—particularly core fixed income—have provided limited downside protection. The historical inverse correlation between stocks and bonds has reversed, consistent with regimes of elevated inflation and rising interest rates. From 2022 onward, the Bloomberg U.S. Aggregate Bond Index fell in 14 of the 17 months when equities also declined, highlighting the limitations of traditional diversification in this environment.

3) Over-Diversification and Complexity

More is not always better. Without strategic design, portfolios can become overly complex or contain overlapping exposures. This may result in the illusion of diversification while retaining significant risks.

Advisors must also distinguish between hedges and diversifiers—and recognize that their effectiveness can vary dramatically across market cycles. For example, gold or volatility strategies may provide strong protection in one downturn but limited support in another. Likewise, “flight to safety” assets like the U.S. dollar or Treasuries are not universally reliable. Successful diversification may include a mix of “first responders” (such as tail-risk hedges) and “second responders” (like managed futures), which may perform better as dislocations persist.4 Even alternative diversifiers, like private credit or insurance-linked strategies, require careful evaluation due to their unique risk-return profiles.

Ultimately, one of the most powerful hedges is investor understanding—grounded in strong advisor communication and planning.

4) Short-Term vs. Long-Term Perception

Diversification is a long-term strategy, but investor expectations are often short-term. This gap can create disillusionment, especially during market cycles where diversification temporarily lags more aggressive approaches. The danger lies in abandoning a sound diversification strategy precisely when it is needed most.

“Diversification is a long-term strategy, but investor expectations are often short-term.”

Taken together, these critiques and benefits highlight the importance of thoughtful diversification—not just in theory, but in practice. The question is not whether to diversify, but how to do so more effectively in a new regime of volatility and structural change.

“The danger lies in abandoning a sound diversification strategy precisely when it is needed most.”

The Proof: A Practical Case Study

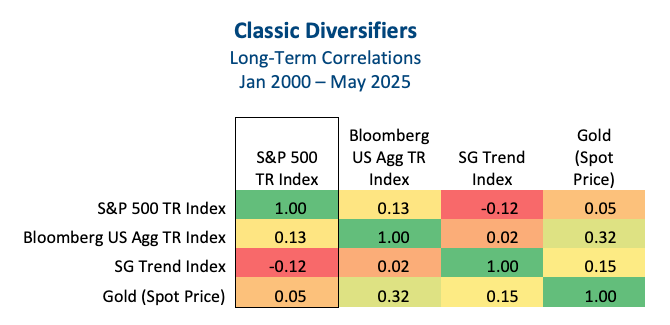

To illustrate the continued relevance of diversification, we evaluated the correlations of major asset classes over the past 25 years. Three were notable for their near-zero correlation to equities during this period, which explains their long-standing reputation as “classic diversifiers”: U.S. bonds, trend-following strategies (i.e., managed futures) and gold.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Other major assets were more highly correlated to equities over the longer time period: commodities, private equity, REITs, leveraged loans, and hedge funds. To isolate the benefits of diversification, we excluded the more correlated assets and constructed an equal-weighted portfolio of the four least-correlated asset classes. This model serves as a clear framework for advisors seeking a blend of complementary exposures.

Uncorrelated Assets — The Four Asset Portfolio: Stocks, Bonds, Trend-Following, and Gold

The 4-Asset Portfolio combines each of the four assets above at equal 25% weights, rebalanced annually.

While correlations can fluctuate in the short term—such as the recent elevated correlation between stocks and bonds—these four foundational diversifiers have exhibited low, and in some cases negative, correlations with one another over the past 25 years. This long-term behavior reinforces their value as effective building blocks in a diversified portfolio. The fact that correlations shift over time is precisely why advisors should avoid relying on any single diversifier; true resilience comes from a thoughtful combination of complementary exposures.

Blended Portfolios and Long-Term Performance

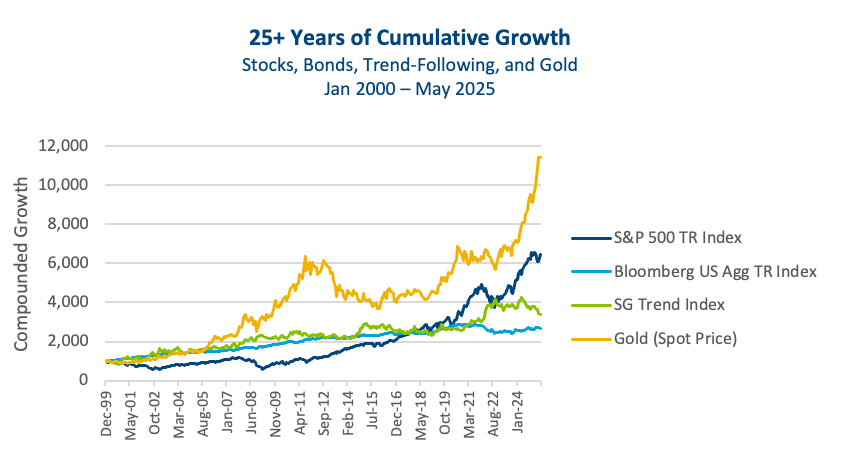

While each of the four asset classes has unique characteristics, their differences begin to reveal the structural benefits of diversification:

- Although Gold posted the highest cumulative return since 2000, it endured a prolonged trough from 2011 to 2021.

- Stocks outperformed in growth phases but experienced significant drawdowns.

- Bonds provided stability, yet underperformed in inflationary and rising-rate environments.

- Trend-Following strategies delivered value during sustained macro dislocations but displayed sensitivity to timing. As such, investors should consider them complementary to traditional hedges—but providing value in sustained downturns or regime-shifting environments.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

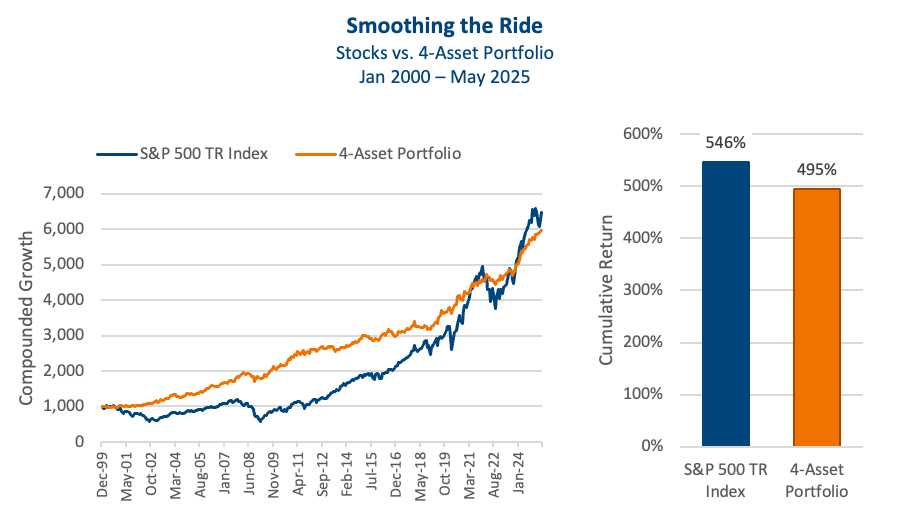

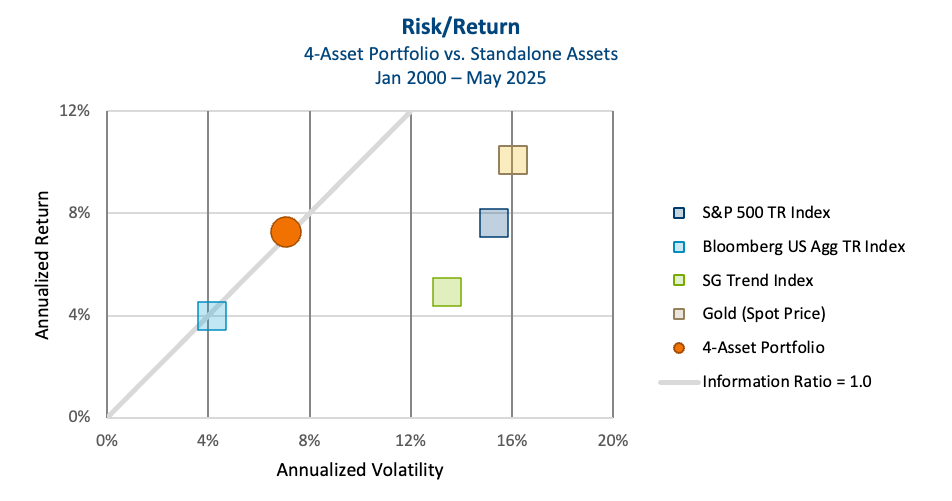

These asset classes exhibit widely differing risk and return streams, the basis for diversification. When blended into a 4-asset, equal-weighted portfolio, rebalanced annually, the outcome was compelling: equity-like long-term returns with substantially reduced volatility.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

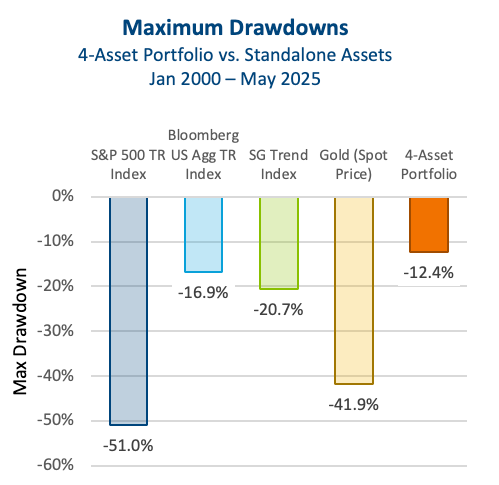

Drawdowns: A Clear Differentiator

Perhaps most notably, the diversified portfolio experienced significantly lower drawdowns. While the S&P 500 registered a maximum drawdown of more than 50%, and gold fell by over 40%, the 4-asset portfolio’s worst peak-to-trough decline was limited to approximately 12%. This level of downside mitigation underscores diversification’s ability to enhance portfolio durability during periods of market stress.

Mitigating drawdowns allows the advisor and client to “sleep at night,” make better decisions, and rebalance prudently across changing cycles. It also helps reduce emotional decision-making and keeps clients committed to long-term plans.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

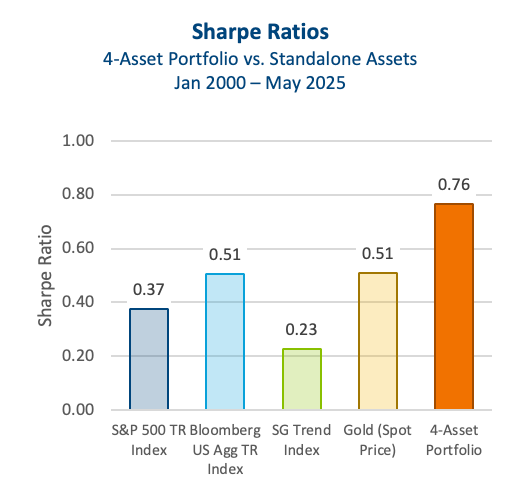

Sharpe Ratios and Risk-Adjusted Returns

Risk-adjusted returns provide a clearer lens through which to evaluate diversification. Fixed income and gold posted the highest Sharpe ratios of the four individual assets while equities and gold delivered higher absolute returns, but with greater risk. The diversified 4-asset blend achieved the highest Sharpe ratio overall, combining competitive returns with significantly improved risk management.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Finding the Sweet Spot: Return, Risk, and the Power of the Mix

Each standalone asset occupies a very different region of the risk-return map. Equities deliver strong long-term returns—but with substantial volatility. Over the long-term, gold has provided the highest returns of the group, but with the greatest volatility. Trend-following floats near the high return assets, while fixed income sits in the low-return, low-risk corner.

When we plot the risk-return profile of the four-asset portfolio, the blend dynamically approaches the symmetry line—where risk and return find equilibrium—providing striking benefits: equity-like returns with meaningfully lower volatility.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

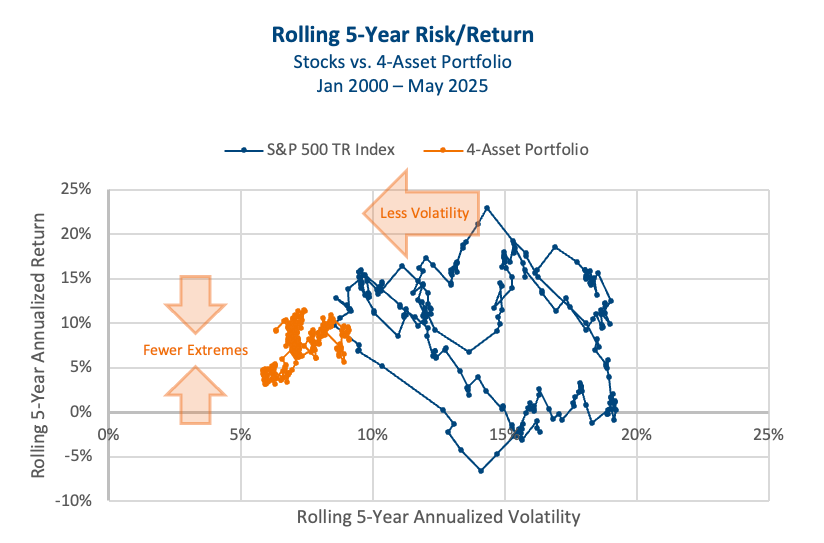

Consistency is Key: Rolling Risk and Return

An analysis of rolling five-year return and volatility reveals another advantage of diversified portfolios: consistency. While equities displayed wide swings across time periods—ranging from strong outperformance to periods of elevated risk—the diversified blend offered a more stable and repeatable experience. This consistency helps investors maintain discipline and remain invested over time, supporting the long-term compounding process.

Each plotted point above represents a new rolling 5-year return-to-risk point since January 2020, with connecting lines revealing the investor’s journey over time.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Our case study illustrates how diversification can provide a better risk-return experience for investors. This straightforward example reinforces the enduring power of combining non-correlated assets, a principle first formalized by Harry Markowitz more than 70 years ago, and still essential to building resilient portfolios today.

Understanding the Role of Trend-Following

It is important to recognize that certain diversifiers, such as trend-following strategies, may not respond immediately during downturns. These approaches often remain long during the early stages of a selloff and tend to benefit as dislocations deepen and directional patterns strengthen. As such, investors should consider them complementary to traditional hedges—but providing value in sustained downturns or regime-shifting environments.

Implications for Advisors:

Applying These Lessons to Real-World Portfolios

1) Reframe Expectations

Diversification is not designed to outperform concentrated strategies in every period, but rather to improve consistency and reduce the impact of adverse market events.

2) Move Beyond 60/40

In the current environment, expanding the diversification toolkit to include alternative assets and differentiated return streams is increasingly prudent.

3) Each Client is Different

While the principles of diversification are universal, a custom approach may be needed for each client or group of clients with shared risk-return profiles.

4) Prioritize Long-Term Resilience

The true test of diversification is not in short-term performance, but in its ability to support long-term investment outcomes through improved stability and reduced behavioral risk.

Conclusion: Evolving Diversification for a New Era

Diversification remains as relevant as ever—but it must be applied with sophistication and forward-looking perspective. As asset classes shift and markets grow more complex, the new imperative is to refine, enhance, and modernize the diversified portfolio.

For investors and advisors alike, building resilient portfolios requires revisiting the foundational principles of diversification and adapting them to today’s realities.

As the case study above illustrates, combining multiple assets with positive expected returns and low correlations can produce portfolios with an improved risk-adjusted profile and smaller drawdowns.

It’s just math—the foundation of diversification done right.

“Diversification is both observed and sensible…

A rule of behavior which does not imply the superiority of diversification must be rejected.”̶ Harry Markowitz

+ + +

Endnotes

Alternative investments (e.g. hedge funds or private equity investments) are complex instruments and may carry a very high degree of risk. Such risks include, among other things: (i) loss of all or a substantial portion of the investment due to the extensive use of short sales, derivatives and debt capital, (ii) incentives to make investments that are riskier or more speculative due to performance based compensation, (iii) lack of liquidity as there may be no secondary market for hedge fund and private equity interests and none is expected to develop, (iv) volatility of returns, (v) restrictions on transfer, (vi) potential lack of diversification and resulting higher risk due to concentration, (vii) higher fees and expenses associated that may offset profits, (viii) no requirement to provide periodic pricing or valuation information to investors, (ix) complex tax structures and delays in distributing important tax information and (x) fewer regulatory requirements than registered funds. Alternative investments are intended only for investors who understand and accept the associated risks. This product may further include investments in futures and forwards markets which are speculative, highly leveraged and involve a high degree of risk. Volatility increases risk, particularly when trading with leverage. Futures and forward positions cannot always be liquidated at the desired price. Investments can be subject to low liquidity, meaning there may not be a seller or buyer available, when the investor desires to invest or divest.

Benchmarks and indices are shown for illustrative purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the product. The benchmarks and financial indices are used herein as indicators of market performance and for purposes of comparison. This comparison should not be understood to mean that there will necessarily be a correlation between the return of the program and these benchmarks since the constitution and risks associated with each benchmark or index may be significantly different. Accordingly, no representation or warranty is made as to the sufficiency, relevance, importance, appropriateness, completeness, or comprehensiveness of such comparison for any specific purpose.

Welton Investment Partners LLC is a Delaware limited liability company that provides investment advisory and day-to-day operational services previously assumed by Welton Investment Corporation, its predecessor, which itself merged from a California corporation originally formed in 1988. Welton Investment Partners is a signatory to the Standards Board for Alternative Investments (SBAI) Best Practice Standards in relation to disclosure, valuation, risk management and fund governance.

This document is not a solicitation for investment. Such investment is only offered on the basis of information and representations made in the appropriate offering documentation. Any investment program described herein is speculative, involves substantial risk and is not suitable for all investors. No representation is being made that any investor will or is likely to achieve similar results.

The information contained herein is not for retail investors but intended for use by institutional and professional investors including “Qualified Purchaser” within the meaning of the 1940 Act which also qualifies it for the status of “Qualified Eligible Person” under CFTC Regulation 4.7. This document is not a solicitation for investment. Such investment is only offered on the basis of information and representations made in the appropriate offering documentation. Past performance is not necessarily indicative of future results.

Copyright © 2025 Welton Investment Partners® All rights reserved.

1 Harry Markowitz, “Portfolio Selection”, The Journal of Finance, Vol. 7, No. 1. (March 1952), pp. 77-91.

2 “Harry M. Markowitz Biographical”, The Nobel Prize, 1990.

3 Markowitz, pp. 87-90.

4 Ryan Lobdell, Jason Josephiac, and Brian Dana, “Risk Mitigating Strategies (RMS) Framework”, Maketa Investment Group—Whitepaper, March 2023.