Welton Advantage

Equity Hedge

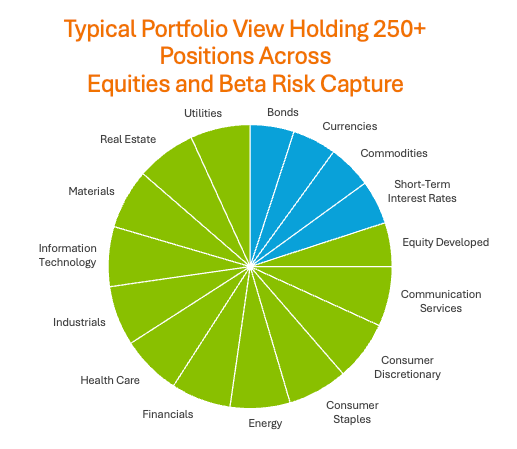

Welton Advantage, the firm’s equity hedge program, seeks to diversify passive equities by combining active equity returns with improved risk management and downside capture over a full range of market conditions. The strategy applies systematic strategies in a multi-layer design across a potential universe of 1,000 equity securities, futures, and options seeking active return and/or risk advantages from each layer.

Welton Advantage seeks to deliver:

-

Return Advantage: Outperform its peer group over an investment cycle.

-

Downside Advantage¹: Outperform with less downside during periods of broad equity market declines.

-

Risk Advantage: Higher risk-adjusted returns than its equity index benchmark.

¹ “Downside Advantage” is defined as cumulative outperformance during negative performance months for the MSCI World Index, achieved via Welton Advantage’s diversifying active equity and active global futures and options strategies that seek to mitigate losses during equity market correction periods. By design, the diversifying strategies are constructed to be uncorrelated and even negatively correlated to the equity universe over reasonable holding periods, however, performance correlations may periodically rise over shorter time periods. There is no guarantee that diversifying strategies will prevent against losses from the active equity portfolio or from each other. Moreover, investors may experience greater losses due to the inclusion of the diversifying strategies.

Curious About Our Performance?

Complete the form to receive a current Strategy Overview via email.

Care to Learn More?

Complete the form and we’ll be glad to answer your questions and/or arrange a time to speak.

Process Focus

Philosophy

- Centers on managing risk and capturing returns from multiple levels

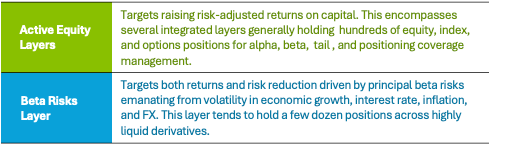

Design

- Applies systematic strategies in a multi-layer design across a potential universe of 1,000 equity securities, futures, and options seeking active return and/or risk advantages from each layer.

- Principal layers:

Curious About Our Performance?

Complete the form to receive a current Strategy Overview via email.

Care to Learn More?

Complete the form and we’ll be glad to answer your questions and/or arrange a time to speak.